Opinion

2/5/2019 Polk Perspective: Rescue taxpayers from mounting student debt | TheLedger.com Page 1 of 3

Polk Perspective: Rescue taxpayers from mounting student debt

S

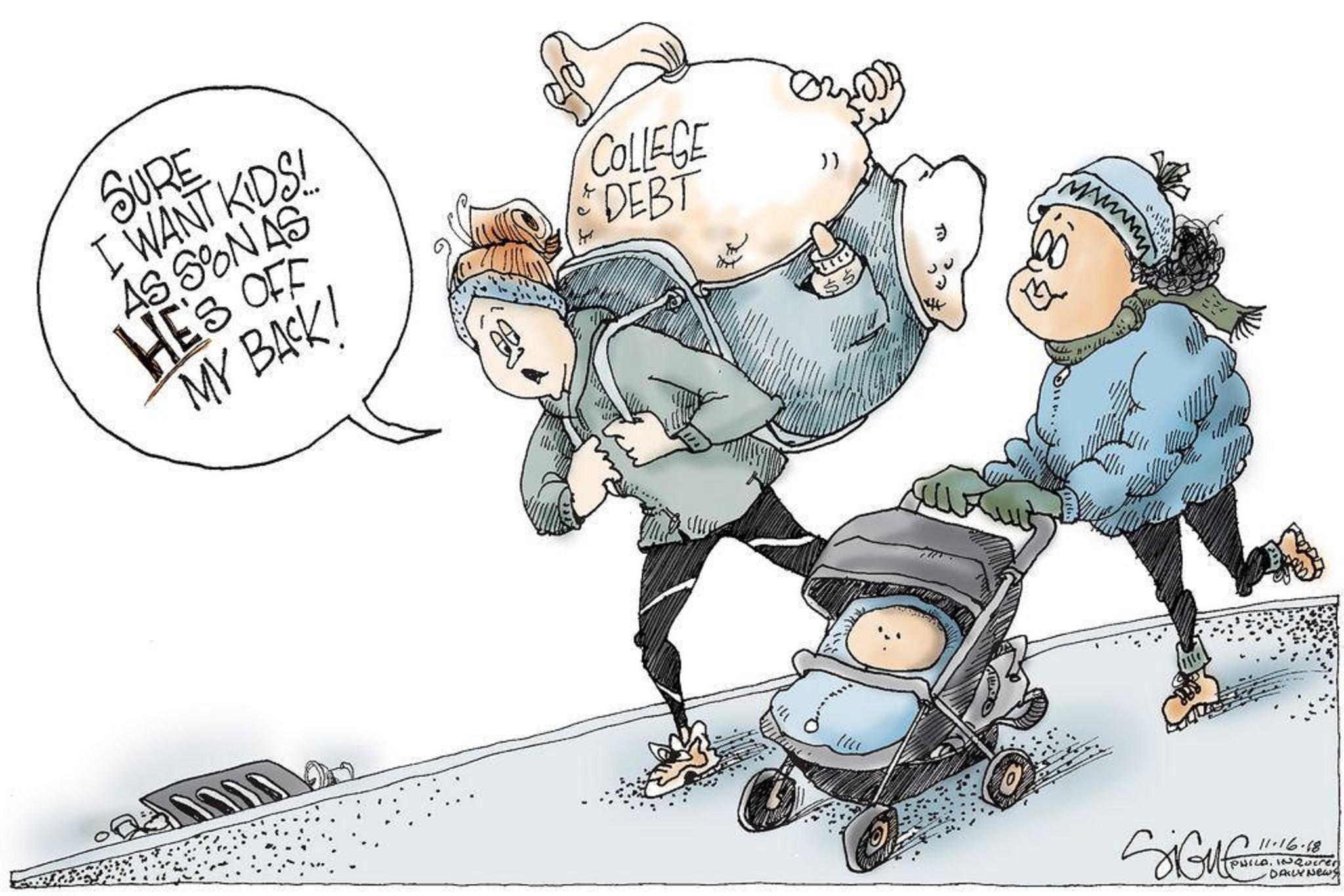

igne

Wilkinson, Philadelphia Daily News

By Gordon Wayne Watts / Guest columnist

Posted Nov 16, 2018 at 12:01 AM

![]()

On Aug. 4, 2016, The Ledger published my guest column on student debt, and not coincidentally, U.S. Rep. Dennis Ross, R-Lakeland, the subject of my column, introduced HR 6191, the “Student Loan Repayment Act of 2016,” on Sept. 27 that year.

What have we learned since then?

Apparently nothing.

https://www.theledger.com/opinion/20181116/polk-perspective-rescue-taxpayers-from-mounting-student-debt 2/5/2019 Page 1/3

2/5/2019 Polk Perspective: Rescue taxpayers from mounting student debt | TheLedger.com Page 2 of 3

First a caveat: While I’ll continue my unrelenting political attack on Ross’ liberal tax-and-spend policies, I’m not attacking him as a person, and condemn not only actual attacks, which we’ve seen of late, but even verbal insults. We can disagree without attacking the person.

HR 6191 was a small step in the right direction, but it was basically just an employer tax credit to help match funds for college debt, and optional at that. It never passed into law.

My prior column documented Ross’ promise to not only support bankruptcy equality for collegiate loans, but also opposition for use of tax dollars to make or guarantee said loans. But he never introduced legislation for either. Where has that gotten us?

Collegiate debt, now almost $2 trillion, is almost 10 percent of total U.S. debt. I predict we will crash the U.S. dollar if we ignore “crazy Gordon” one more time.

But it’s worse than that.

While 10 percent may not seem like a lot — national defense and Social Security are about 60 percent of the budget — use of tax dollars to make or back collegiate debt can be eliminated totally, unlike defense and other programs, which can only be cut a tiny bit, for both political and actual reasons.

Indeed, back in the 1950s we used little or no tax dollars for college loans. They got credit cards, if they needed credit. Most didn’t, since college was affordable in the first place.

Short of World War III, or a terrorist attack, the crash of the dollar is the worst disaster we face.

Our Founding Fathers, victims of British banks and merchants’ predatory lending, included bankruptcy rights in the Constitution, ahead of the power to raise an army and even to declare war. Known as the “Uniformity Clause,” it is a special type of equal protection. Said John Adams, “There are two ways to enslave and conquer a nation. One is by the sword. The other is by debt.”

So, I call on Ross to introduce a bill to begin reversing the loan limit increases made by the “College Access and Opportunity Act of 2005,” a bill by former House Speaker and RINO John Boehner.

This is why I call fellow Republicans “spending” liberals, as we spend tax dollars for something that we not only didn’t need in the past, but which, actually, induces colleges to increase tuition to match increased borrowing abilities.

And the “tax” part? Well, tuition is technically a tax, as it’s funding to an arm of government (state goverment colleges), and students are sorely overtaxed.

I also call on Ross to co-sponsor HR 2366, which would afford student loans the same bankruptcy protection as, say, credit cards, and also unsecured debt — President Donald Trump’s businesses repeatedly got bankruptcy discharge for millions.

Does the Constitution, or fiscal conservatism, matter to Republicans anymore?

https://www.theledger.com/opinion/20181116/polk-perspective-rescue-taxpayers-from-mounting-student-debt 2/5/2019 Page 2/3

2/5/2019 Polk Perspective: Rescue taxpayers from mounting student debt | TheLedger.com Page 3 of 3

Ross used to be a fiscal conservative while in the Florida House. But it’s documented that then-Speaker Marco Rubio punished Ross and one other representative for voting against the costly, and risky, reinsurance bill that made Citizens Property Insurance the largest property insurer in Florida.

Ross voted to get the tax dollar “off the hook” for this liberal tax-and-spend boondoggle, and was booted off a committee for it. Now that he’s in Congress, he seems afraid to do the right thing.

I encourage him to do the right thing in the use of our tax dollars. If HR 2366 passes, taxpayers will not have to bail out students filing bankruptcy. In fact, bankruptcy, the “economic Second Amendment,” would

scare off lenders — resulting in decreases in loans, and lower tuition — and the sharp decline in collegiate loans would save taxpayers huge amounts, not counting the millions in interest we pay on these toxic, predatory and subprime collegiate loans.

Gordon Wayne Watts (contact him at GordonWatts.com or GordonWayneWatts.com) is a Lakeland resident and a former candidate for the Florida House of Representatives.

https://www.theledger.com/opinion/20181116/polk-perspective-rescue-taxpayers-from-mounting-student-debt 2/5/2019 Page 3/3